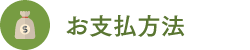

An employer who requires or permits an employee to work overtime is usually required to pay the employee a bonus for that overtime. Employees covered by the Fair Labor Standards Act (FLSA) must be paid for overtime of more than 40 hours per work week, at least one and a half times their regular salary. The RSA does not require overtime pay for work on Saturdays, Sundays, statutory holidays or regular rest days, unless overtime is worked on those days. Most workers in the U.S. are entitled to overtime pay, which should occur after you have worked more than 40 hours in a given week. Since the typical overtime rate of pay is 1.5 times your regular rate of pay, this increased wage requirement has been dubbed “the hour and a half.” Divide your total income for the work week, including income during overtime, by the total working time during the work week, including overtime. For each additional hour worked, you are entitled to an additional half of the regular rate for hours that take time and the full rate for hours that require twice as much time. To get to your double time rate, simply double your regular rate (multiply it by two). For the example above, your double pay rate would be equal to $20 times $2 or $40 per hour. CLICK HERE for more information on U.S.

Department of Labor Payroll and Hours overtime. Want to share our double-time infographic on your own website? Just copy and paste the following code:

Please add an assignment to WageAdvocates.com in this graph.

Lucy works 2 p.m. on Mondays. She is subject to California wage regulations, so her employer must charge overtime wages. However, her time for the day actually exceeds 12 hours, so she will line up to receive a double rate of pay on top of normal overtime pay. Keep in mind that the federal fair labor standards that govern basic payroll practices in America do not require employers to pay double pay. However, there are a number of exceptions to the Overtime Act. An “exemption” means that the Overtime Act does not apply to a particular classification of employees. There are also a number of exceptions to the above-mentioned General Overtime Act. An “exception” means that overtime for a particular classification of employees is paid on a basis other than that mentioned above. In other words, an exception is a special rule. (For special overtime rules for agricultural workers, see Overtime for agricultural workers.) Overtime is based on the regular rate of pay, which is the pay you usually earn for the work you do.

The regular rate of pay includes a number of different types of compensation, such as hourly wages, salaries, piecework wages, and commissions. Under no circumstances may the regular rate of pay be lower than the applicable minimum wage. Union members may be an exception. Some union contracts provide for a double rate of pay, especially very long working days, but you should check with your own contract if there is a double time (in addition to overtime) in your case. According to the California Department of Labor Relations, eligible state workers are entitled to a double pay in one of two cases: Next, we discuss where and when double overtime applies. The RSA was enacted in 1938 to protect employees from poor quality conditions in the workplace. The law sets not only the minimum wage, but also the overtime wage at one and a half times the hourly wage. Criteria have been established for the types of jobs exempted from the FLSA Regulations, as well as restrictions on the terms and conditions of employment of children. The intention of the law was to establish minimum standards for the working conditions that employers must respect.

Double-time pay and even overtime for work on Saturdays, Sundays or holidays is not required by the RSA, according to the U.S. Department of Labor. However, the calculation of overtime is more difficult for exempt workers than for non-exempt workers. Employers should consider other forms of payment, such as certain bonuses or commission payments, that may change an exempt employee`s normal hourly rate. For non-exempt employees, overtime and double work hours can easily be added to the normal working hours of the 40-hour week. Nor do they apply to non-exempt workers who have agreed to work on another work schedule. [2] These schedules must be approved by at least two-thirds of the employees concerned. Schedules may require employees to be clocked for up to 10 hours a day without overtime. Workers with alternative work schedules should always work overtime if they: California state law does not require or prohibit employers from paying exempt workers for overtime at one and a half times their regular wage. Employers can even pay these employees a double rate of time if they wish.

However, only a few employers opt for it. Those who pay exempt employees at an overtime rate often do so at: In some situations, however, state law doesn`t matter because some employers offer double pay, often in addition to overtime, in the hope that the promise to pay twice will force employees to work shifts that are usually undesirable. Dual-time incentives may be available for work on federal holidays, night shifts or, in rare cases, weekends. Double Time vs Overtime – The Difference in California » Double Time vs Overtime – The Difference in California It depends. An employee must be paid overtime unless they meet the exemption status requirement under federal and state laws or are expressly exempt from overtime by the provisions of the California Labor Code or one of the Industrial Welfare Commission`s wage orders that govern wages, hours, and working conditions. This article answers some frequently asked questions about overtime pay. This document is a complete excerpt from the U.S. Department of Labor website. Overtime wages must be paid no later than the pay day of the next normal pay period after which overtime wages were earned.

(Labour Code § 204) Only the payment of overtime wages can be deferred to the pay day of the next accounting period, since direct wages must still be paid within the period specified in the section of the Labour Code in force of the pay period in which they were earned; or, in the case of employees paid weekly, every two weeks or every two months, not more than seven calendar days after the end of the accounting year […].