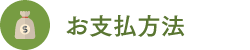

Descartes Visual Compliance™ Sanctioned Party Ownership Screening can help companies prevent potential transactions that would violate the property regulations of sanctioned parties. By providing easy-to-understand information on the percentage of ownership or control by parties on OFAC and EU sanctions lists, users can quickly see when a company that is not on a government watch list would be affected by OFAC`s “50% rule” as well as similar rules from other jurisdictions and should be considered a rejected party. In summary, it is important to understand OFAC`s sanctions rules, understand in which sanction or specially designated national (SDN) you are involved, make appropriate and compliant assessments and decisions, and consult with a lawyer if necessary. The Treasury Department`s FAQ on the OFAC 50% Rule “requires individuals considering a potential transaction to perform appropriate due diligence for companies involved in or involved in the transactions or with which account relationships are maintained to determine relevant ownership shares.” Take your time when dealing with a possible OFAC game. Once you engage in a business transaction, your due diligence opportunity is completed with the transaction. Time constraints are always an issue, and this is especially true during the pandemic, but this is a scenario where it is of paramount importance to take time with your documents and evidence before engaging in the relevant transaction or business activity. In addition, OFAC has a good FAQ navigation resource on this topic. By including Descartes` visual compliance sanctioned party ownership filtering in their compliance processes, companies can help mitigate risk by identifying sanctioned parties within the ownership structure of their customers, customers, and business partners. As noted in the rule, if your organization transacts with an entity that is 50% or more owned by one or more SDNs, it has violated the 50% rule. Barclays Bank was fined $2.4 million by OFAC for doing just that. According to OFAC`s enforcement action against Barclays, the activity took place between 2008 and 2013 and included 159 transactions with a company that “directly or indirectly owned 50% or more of an identified person on the OFAC-SDN list.” Control of the company caused ExxonMobile to go bankrupt to the tune of $2 million.

According to OFAC`s enforcement action against the energy giant, it entered into eight commercial agreements with a company (not on the SDN list) signed by a Russian oligarch who was on the SDN list. Regarding its 50% rule, OFAC explicitly states that “U.S. individuals should be cautious when doing business with unblocked companies involving blocked individuals.” In addition, they are “not allowed to enter into contracts signed by a blocked person”. The amended guidelines go even further and also use the 50% threshold in situations where there is indirect ownership and where several sanctioned persons join forces to hold a 50% or more stake in a company. “Any company owned directly or indirectly by 50% or more of one or more persons blocked in total is itself considered a blocked person,” the new guidelines state, “whether the company itself is listed in the schedule of an executive decree or otherwise appears on ofAC`s list of specially designated nationals (SDN).” A person or company covered by U.S. law may not engage in any transaction with such a company unless approved by OFAC. “A person in the United States may not, directly or indirectly, obtain or transact goods, services, or technology from a blocked person or organization. Whether or not such entities appear on specially designated and blocked OFAC nationals, the ownership data of parties sanctioned by descartes visual compliance has been carefully reviewed by experienced analysts at research centers around the world to provide assurance that the data is accurate and up-to-date. 2. Gather all relevant information before making decisions In November, the Federally Regulated Financial Institutions Review Board (FCEFI) issued a joint statement on cybersecurity sanctions from the Office of Foreign Assets Control (OFAC).

He warned that many companies sanctioned for malicious cyber activities claim to be based nationally and provide technology-related services to financial institutions under false pretenses. These sanctioned companies increase both OFAC`s operational risk and compliance risk to institutions that have used or continue to use their services. The U.S. Treasury`s Office of Foreign Assets Control (OFAC) 50% rule states that the ownership and ownership interests of companies directly or indirectly owned 50% or more by one or more blocked persons are considered blocked. In applying this rule, OFAC determines whether companies that do not appear on the SDN list are considered blocked because they are owned by companies or individuals on the SDN list. Dow Jones` Risk and Compliance Unit, which creates its own Sanctions Ownership Research List (SOR) — a list of companies holding 10% or more of an SDN — also notes that blocked people are known to structure their assets so as not to trigger the 50% rule. With Descartes Visual Compliance, you can check how it works best for your business. Whether you`re doing an online screening, in bulk, or by integrating with your business system, we can help you get up and running in a single day. The blocked person X has 25% of entity A and 25% of entity B. Entities A and B each have 50% of entity C. Entity C is not considered blocked. This is because the blocked person X represents less than 50% of the shares of entity A and entity B, respectively.

In addition, neither Entity A nor Entity B is blocked, and Person X blocked is not assumed to indirectly own any of Entity C through its co-ownership of Entity A or B. The first violation cited occurred when the company sold goods to a company that was not itself listed as SDN, but was 51% owned by an SDN. At the time of the tech company`s second and third transactions, the buyer had been added to the SDN list, but the company`s “denied party filtering” did not result in any warnings or warnings. For these three offences, the company was fined $87,507. Entities blocked either by an Executive Order or by regulations managed by OFAC are broad and include all assets or interests in tangible or intangible assets, including present, future or contingent interests. .